Robin Edwards Financial Blog

|

|

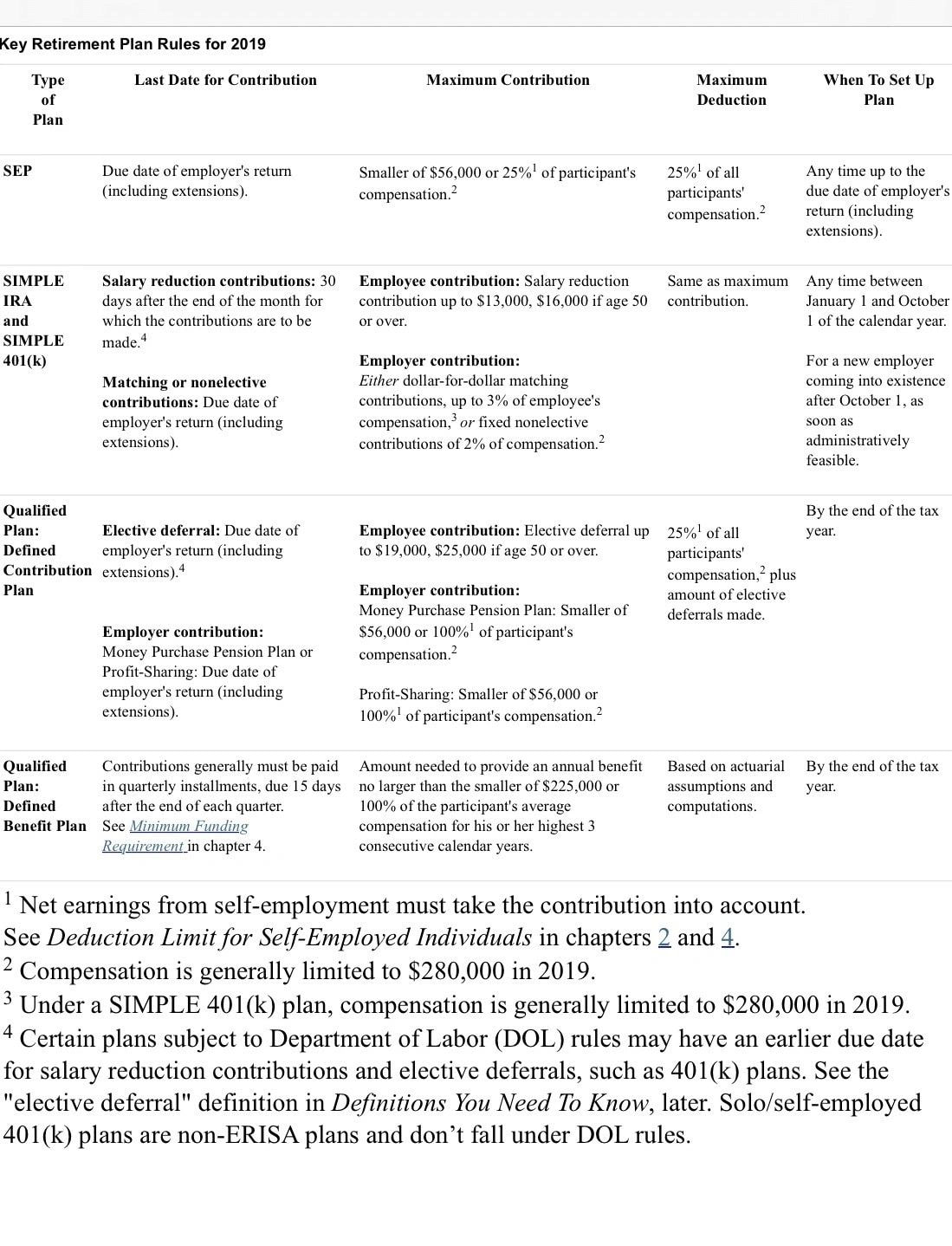

This is a continuation of the blog from yesterday with some updates and a chart which helps explain the retirement plan options. The Table above is from the IRS website for verification. REPEAL OF MAXIMUM AGE FOR TRADITIONAL IRA CONTRIBUTION: Starting Jan 1, 2020, the rule that you aren’t able to make contributions to your traditional IRA for the year in which you reach age 70.5 and all later years has been repealed.

REQUIRED MINIMUM DISTRIBUTION AGE (RDM): Starting Jan 1, 2020, the age for the required beginning date for mandatory distribution is changed to 72 for taxpayers reaching the age of 70.5 after Dec 31, 2019. Small Employer automatic enrollment credit: The Further Consolidated Appropriations Act (FCAA), 2020, P.L 116-94, added section 45T. An eligible employer may claim a tax credit of $500 per year over a 3-year period beginning with the first tax year after Dec 31, 2019 when it sponsors a qualified employer plan including an eligible automatic contribution arrangement. Increase in credit limitation for small employer plan startup costs: The FCAA amended section 45E . For Tax year 2020 a small employer can claim a tax credit for first year and 2 years immediately following for up to 50% of qualified startup costs, between $250 to $500 per employee or up to $5,000. Qualified automatic contribution arrangement (QACA) safe harbor plans: Starting in tax year 2020, when an employee doesn’t make an affirmative election specifying a deferral percentage. The maximum default deferral percentage increased from 10 % to 15%. Retirement savings contributions credit: Retirement plan participants (including self-employed individuals) who make contributions to their plan may qualify for the retirement savings contributions credit (RSCC). The maximum contribution eligible for credit is $2000. Taxpayers are eligibile for the RSCC if there are 18 years of age or older, not a full-time student and not claimed as a dependant on another person’s return. Small Business retirement plans:

Any Questions email at [email protected]

0 Comments

Leave a Reply. |

Contact Us(602) 770-9300 Archives

September 2021

Categories |

We are licensed in AZ, MD, GA, TN, FL, TX, OH, NY & NC

Navigation |

Connect With UsShare This Page |

Contact Us |

Location |

Old growth Saguaro Cactus at Sunrise Near Phoenix AZ photo by Ray Redstone | CC-BY-SA-4.0 | Website by InsuranceSplash

RSS Feed

RSS Feed