Robin Edwards Financial Blog

|

|

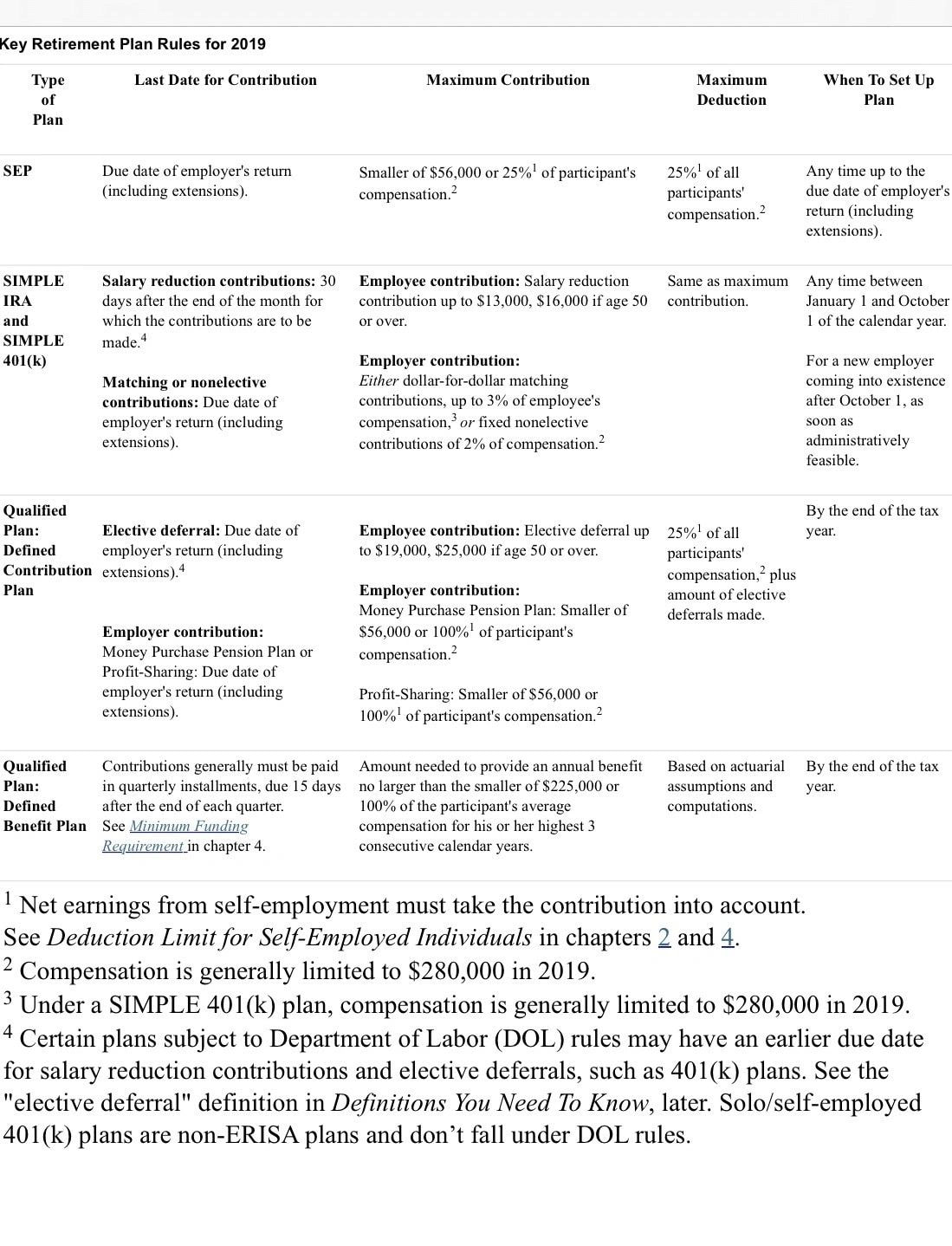

This is a continuation of the blog from yesterday with some updates and a chart which helps explain the retirement plan options. The Table above is from the IRS website for verification.

0 Comments

COVID19 has really stopped many people's lives and businesses abruptly. This is a huge health concern that is global without an existing treatment to help the affected people recover. As time has passed by since the emergency declaration by President Trump, COVID19 continues to be a concern in our live, but more and more businesses are able to connect with and serve their customers and clients through virtual portals. Due to this abrupt stop in business activity the Dow Jones industrial average and the stock market index of global markets have also declined rapidly over the past few weeks. This is time to continue planning for the future since this health concern from COVID19 is temporary. So here are few things to keep in mind for tax and retirement planning for small businesses. Here is a quick outline of what is allowed by the IRS and some general rules.

The IRS has automatically extended the income tax filing due date (deadline) from April 15, 2020 to July 15, 2020 because of the national emergency declared by President Trump on March 13, 2020. Any taxpayer can also defer federal income tax payments due on April 15, 2020 to July 15, 2020 without penalties & interest, regardless of the amount owed. This includes individuals, trusts and estates, corporations and other non-corporate tax filers including those who pay self-employment (SE) tax.

No additional forms or notifications of any kind are required by taxpayers to take advantage of the new tax filing deadline July 15, 2020. Individual tax payers who need additional time beyond the July 15, 2020 can request an extension by filing form 4868 and businesses that need additional time can request an extension by filing form 7004. Everyone is encouraged to file taxes as soon as possible especially if a refund is due because the refund will be issued within 3 weeks or 21 days after filing. The IRS encourages taxpayers to file electronically with direct deposits to get a refund quickly. Critical departments of the IRS are open for business during this national emergency and they will process tax returns and refunds as quickly as possible. Stay tuned for more guidance from the IRS on any further tax relief during the COVID-19 national emergency. Contact us at [email protected] to get your taxes prepared and filed to the IRS. SBA is very specific about who in your business should be included while calculating payroll costs for the PPP Loan. Businesses applying for the PPP loan should include employees' salary, wages, commissions, and/or tips. All benefits paid to the employee which include sick leave, paid time off, health coverage, 401k or other retirement plan funds, state & local taxes, and any other allowance for separation or dismissal should be included. The application requires businesses to submit form 940, payroll expenses report from Jan 1 to Feb 15, 2020, some banks require bank statements if you don't have an existing relationship, some require both form 940 from 2019 & W3 filed for 2019.

Self-employed individuals, who are generally independent contractors or sole proprietors are not part of the payroll calculations because they are not employees. They should apply for their own PPP loan with their SBA lender and provide appropriate documentation such as 1099 or their bank statements as proof of income. SBA also excludes any payroll costs to individuals who do not have a principal place of residence as the United States, any compensation greater than $100,000 per year is excluded from calculating payroll costs for the loan, federal income taxes withheld, including FICA, Railroad Retirement Act taxes (both employee and employer's share) are excluded from feb 15, 2020 to June 30, 2020. Qualified Sick leave and family leave wages for which a credit is allowed under the Families First Coronavirus Response Act is also excluded. The interest rate will be 1% or 100 basis points on the PPP loan, the maturity is two years with a maximum maturity of up to ten years from the date the borrower applies for loan forgiveness. The first payment is due six months from the date of disbursement of the loan, however, interest will continue to accrue on the PPP loan during the six-month deferment period. The borrower can apply for loan forgiveness for which the full principal amount can be forgiven based on how much of the loan was used for payroll costs. There will be more guidance issued on forgiveness by the SBA. Email at [email protected] with questions. According to the Federal Register, vol 85, No. 63 published on April 1, 2020 under Rules and Regulations, the SBA has modified the eligibility and the loan approval deadline and extended this pilot program that was introduced as a pilot program on Oct 16, 2017. After the declaration of a national emergency by President Trump on March 13, 2020 that adversely affected all states including DC, the SBA expanded the EBL program eligibility to all businesses nationwide adversely impacted by COVID-19. The deadline for approval for this loan is extended from Sept 30, 2020 to March 13, 2021. This 6 month extension of the deadline will allow small businesses that may experience delayed effects from the COVID-19 emergency. The EBL pilot program authorizes SBA express lenders to provide a streamlined and expedited SBA-guaranteed bridge loan financing on an emergency basis for up to $25,000 for the communities affected by Presidentially-declared disasters. This is a bridge loan because businesses apply and wait for long-term financing through the SBA's direct Disaster Loan program if they are eligible. SBA express lenders only make EBL loans to eligible businesses with an established banking relationship on or before the date of the disaster or emergency declaration. Please visit www.sba.gov for more detailed information on EBL loans. Please send questions to [email protected]

On March 13, 2020, President Donald Trump declared a state of emergency for all states, territories, and the District of Columbia due to the ongoing COVID-19 (Coronavirus Disease 2019) pandemic. The severity and the magnitude of this rapidly spreading pandemic led to a worldwide threat to health, travel, and commerce. The state of emergency allowed the Federal, State and local public health officials to take measures to minimize the public's exposure to the novel Coronavirus. The measures included a mandatory nationwide closure of restaurants, bars, gyms, cancellation of sporting events, large gatherings and restrictions on travel outside the United States. Businesses of all sizes are experiencing an economic hardship as people stay home to keep safe distance from other, stay-at-home orders were mandated, and all non-essential businesses were ordered to close until further notice.

|

Contact Us(602) 770-9300 Archives

September 2021

Categories |

We are licensed in AZ, MD, GA, TN, FL, TX, OH, NY & NC

Navigation |

Connect With UsShare This Page |

Contact Us |

Location |

Old growth Saguaro Cactus at Sunrise Near Phoenix AZ photo by Ray Redstone | CC-BY-SA-4.0 | Website by InsuranceSplash

RSS Feed

RSS Feed